WORLD

Several global issues directly or indirectly affect the supply chain.

We can highlight the long period of conflict between Russia and Ukraine – with no agreement yet expected – the hostilities between Israel and Hamas, worrying the whole of the Middle East, and the trade tensions between China and the US in an American election scenario.

From another point of view, climate change, accentuated year after year, has had an increasing impact on ports and airports, in addition to the increase in the price of oil, which OPEC has already defined as continuous.

AIR AND SEA TRANSPORT

The market downturn in the fourth quarter should rule out a possible boom in volumes and freight in 2023.

Airlines and shipping companies, major “players” in international logistics, have accumulated a drop in their revenues of up to 60%, and the redirection of transport capacity should continue during the first half of 2024.

It should be noted that the maritime market should continue to concentrate on the sector, with articulations and combined services, in order to maintain the adequacy of supply versus demand.

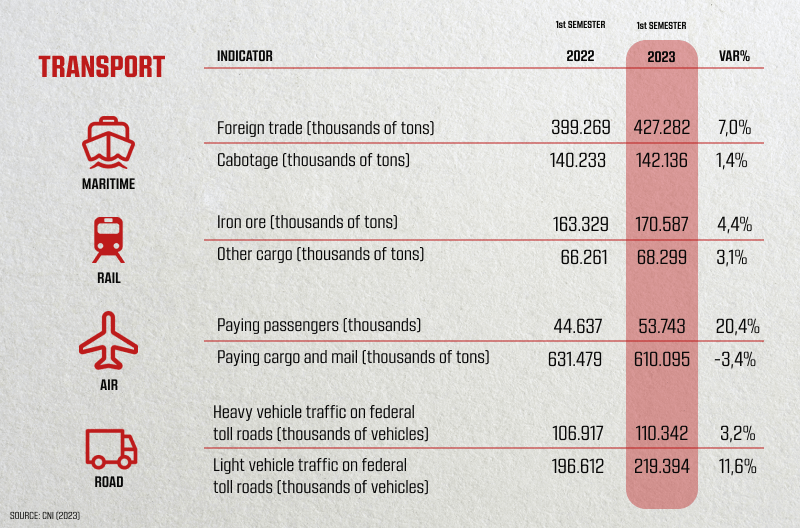

Air transport fell by 3.4% (from 631.4 million to 610 million) and maritime transport saw a 7% increase in cargo handled in Brazilian ports.

TRENDS AND EXPECTATIONS – Q1/2024

Freight, both sea and air, should remain stable with a moderate upward bias, but without significant impacts. Historically, long periods of low freight mean that shipping companies, ports and airports create and increase local charges.

Large logistics operators and shipping companies are likely to enter cycles of staff reductions and lower investments – reducing new construction of both ships and aircraft – and scrapping both.

5 INSIGHTS FOR THE YEAR AHEAD (2024)

- Procurement areas looking for local and intra-regional suppliers to mitigate risks with long-distance partners;

- Increased hiring of BPO companies specializing in Supply Chain, onshore and offshore;

- ESG is gaining relevance in the supply chain, with the sector seeking environmentally and socially responsible logistics;

- The search for and development of technologies for the Procurement and Supply Chain sector continues, with the growth of logtechs, smart warehouses and purchasing platforms;

- Process management and customer service with data-based methodologies and tools promise new products and solutions for those looking for good opportunities in foreign trade

MAC LOGISTIC

Based on valuing people, MAC has been investing in systems and technologies that combine the best of its organizational culture with market developments. Real-time data and the team’s prepared eye contribute to more efficient decisions at every stage of the chain.

With solid ESG practices and being the best company to work for in the logistics segment – and one of the best in Brazil* in the same size – MAC is prepared to guarantee more than logistics by offering the best alternatives on the market to leverage the businesses of today and tomorrow.

*34th Best Company to Work For in Brazil in 2023, according to the GPTW – Great Place to Work Institute.